RISA® stands for Retirement Income Style Awareness®

The plans you keep are the ones you believe in.

Your plans for retirement are no different,

but what is your personal retirement income style?

The good news: You’ve been defining it your entire career.

The hard truth: It can be extremely difficult to define it in any meaningful and actionable terms. UNTIL NOW!

The RISA® is the first financial personality assessment that identifies your retirement income style and implementation approach.

Your plans for retirement are no different,

but what is your personal retirement income style?

The good news: You’ve been defining it your entire career.

The hard truth: It can be extremely difficult to define it in any meaningful and actionable terms. UNTIL NOW!

The RISA® is the first financial personality assessment that identifies your retirement income style and implementation approach.

Think of it as a free counseling session between you and your retirement income plan.

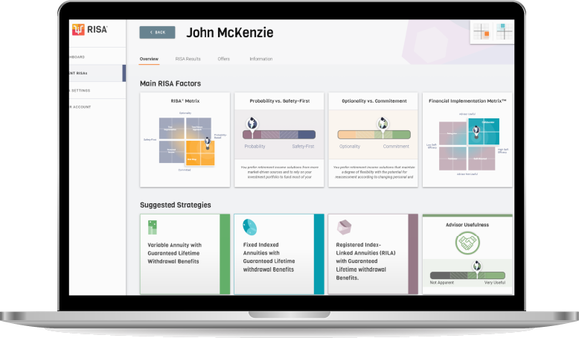

At the end of the session (generally only 15 minutes of your time), you get a clear set of results defining how you would like to source your retirement income and a planning strategy that fits your preferences.

At the end of the session (generally only 15 minutes of your time), you get a clear set of results defining how you would like to source your retirement income and a planning strategy that fits your preferences.

How it works:

The Retirement Income Style Awareness® Profile, the RISA®, is a series of questions asked to help identify your true retirement preferences. Once completed, your results can help you (or your advisor) define strategies that match your personality closer than ever before.

It examines the decision-making factors that you consider important among the various retirement income options and identifies your best fit. Your RISA® Profile takes the best that psychology and financial planning have to offer.

It examines the decision-making factors that you consider important among the various retirement income options and identifies your best fit. Your RISA® Profile takes the best that psychology and financial planning have to offer.

It's simple!

1. Sign Up

Click the link at the top or bottom of this page (or HERE) to be taken to the RISA questionnaire site. Then enter your name, email and a password (so you can access your results anytime) to get started.

2. Answer the Questions

The majority of the questionnaire is done through you choosing between two statements. On the left and right will be a position on an aspect of retirement, and you select which one you feel stronger towards. There are no right or wrong answers, just your own preference.

3. Send and Review

Review your full multipage report on your retirement style. You can use it yourself to inform your retirement decisions, or share it with your advisor to help create a better plan.

1. Sign Up

Click the link at the top or bottom of this page (or HERE) to be taken to the RISA questionnaire site. Then enter your name, email and a password (so you can access your results anytime) to get started.

2. Answer the Questions

The majority of the questionnaire is done through you choosing between two statements. On the left and right will be a position on an aspect of retirement, and you select which one you feel stronger towards. There are no right or wrong answers, just your own preference.

3. Send and Review

Review your full multipage report on your retirement style. You can use it yourself to inform your retirement decisions, or share it with your advisor to help create a better plan.

The Insights You Will Gain:

Primary Retirement Income Style and RISA® Profile

The RISA® measures a variety of factors related to how one would like to source their retirement income. It then translates the style into a snapshot of appropriate, viable approaches that fit these preferences.

The RISA® measures a variety of factors related to how one would like to source their retirement income. It then translates the style into a snapshot of appropriate, viable approaches that fit these preferences.

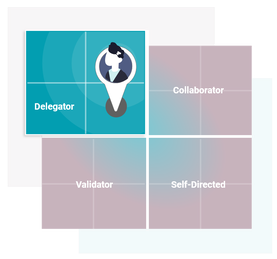

Financial Implementation Matrix

The Matrix helps you identify your particular financial implementation style and how you prefer to implement financial tasks. The matrix is built on two key measures: "advisor usefulness" and "retirement income self-efficacy."

The Matrix helps you identify your particular financial implementation style and how you prefer to implement financial tasks. The matrix is built on two key measures: "advisor usefulness" and "retirement income self-efficacy."

Retirement Income Concerns

This measures the level of worry you feel about achieving our four main retirement objectives. The concerns are listed below:

Longevity

+

Lifestyle

+

Liquidity

+

Legacy

This measures the level of worry you feel about achieving our four main retirement objectives. The concerns are listed below:

Longevity

+

Lifestyle

+

Liquidity

+

Legacy

Secondary Retirement Income Factors

In addition to the RISA® Primary Factors, we developed four secondary factors to provide further refinement of the RISA® Profile. It's broken into four categories discovering preferences with retirement funding around:

In addition to the RISA® Primary Factors, we developed four secondary factors to provide further refinement of the RISA® Profile. It's broken into four categories discovering preferences with retirement funding around:

- Front vs. Backloading

- Accumulation vs. Distribution

- Time-Based vs. Perpetuity

- Technical Liquidity vs. True Liquidity